Concord Closes Nearly $1.8 Billion Fourth ABS, Says ‘The Transaction Was More Than Three Times Oversubscribed’

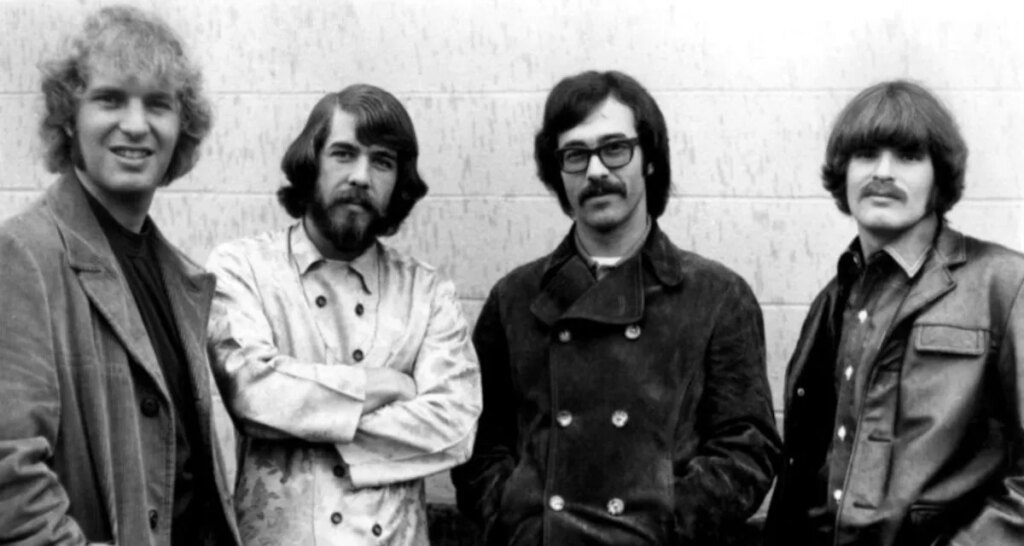

Concord has issued nearly $1.8 billion worth of senior notes secured by song rights from Creedence Clearwater Revival (as well as John Fogerty) and many others. Photo Credit: Fantasy Records

Concord has closed a nearly $1.77 billion ABS that it says is “the largest and longest tenured asset-backed term securitization of music rights to date.”

Nashville-headquartered Concord formally revealed the $1.765 billion ABS – its fourth to date, with the third having arrived in October 2024 – today. At the center of the sizable securitization is the company’s more than 1.3 million-work song catalog.

Boasting a total value of over $5.1 billion, per Concord, that massive pile of IP encompasses stakes in a variety of well-known recordings and compositions. Just scratching the surface here, this includes efforts involving Ed Sheeran, Daddy Yankee, The Beatles, Rihanna, and Imagine Dragons, among many others.

Back to the ABS itself, the Stem Disintermedia owner said it’d issued fresh five-year, seven-year, and 10-year senior notes rated A+ by KBRA as well as A2 by Moody’s.

The decade-long notes were privately placed; Apollo Global Management, not a stranger to Concord tie-ups or music rights, structured the ABS and formed an investor syndicate led by its managed funds and affiliates, according to the appropriate parties.

As highlighted, Concord isn’t new to the ABS world, and several other industry players have rolled out offerings of their own. Despite this point and the considerable number of already-wrapped IP investments – some of which didn’t receive public announcements – the Broadway Licensing Global parent said its latest “transaction was more than three times oversubscribed.”

Concord intends to use the securitization proceeds to repay a $1.65 billion 2022 note series and to refinance and extend a $100 million “variable funding note,” per the announcement.

“As Concord continues to grow both our catalog and frontline roster,” added CEO Bob Valentine, “ensuring long-term access to institutional capital and continuing to build upon our strong financial foundation are crucial.

“ABS transactions like the one we just closed will remain a vital part of our growth strategy, allowing us to continue to lower our cost of capital while expanding our global capabilities in support of the artists and songwriters we serve,” Valentine concluded. “I am incredibly grateful to the Apollo team, who continue to provide customized solutions so that Concord can live out its mission to elevate the voices of artists around the world.”

Previously, 2024 delivered asset-backed securitizations from Kobalt ($267 million) and Hipgnosis ($1.47 billion). Beyond the latter transaction, Sony Music Publishing is reportedly acquiring a piece of the Hipgnosis pie in Hipgnosis Songs Group, we broke down last month.

Link to the source article – https://www.digitalmusicnews.com/2025/07/22/concord-abs-july-2025/

-

Pioneer DJ DM-40D 4-inch Desktop Active Monitor Speaker – Black$149,00 Buy product

-

HYG Cymbal Sizzler Cymbal Chain, Big small 2pcs, Cymbal hiss, Sound effect adjustment Cymbal Chain for Rides, Crashes, Chinas, Drum Kits, Jazz Drums (2108092309)$9,99 Buy product

-

Best Choice Products 30in Kids Acoustic Guitar Beginner Starter Kit with Electric Tuner, Strap, Case, Strings – Blueburst$54,99 Buy product

-

OLIGHT MCC 3 Charger in Balck Upgraded Smart Magnetic Charging Cable Only Suitable for Odin/Odin Mini/PL-Pro/Baton3 Series/Warrior Mini2/Perun 2/Seeker 3 pro/Warrior 3s/Baldr Pro R/Arkfeld/Arkfeld UV$14,99 Buy product

-

Sound Innovations for Concert Band, Bk 1: A Revolutionary Method for Beginning Musicians (B-flat Clarinet), Book & Online Media$11,99 Buy product

-

Healifty Ukulele Carrying Bag Banjo Container 1Pc 4- String Banjo Bag Banjo Case Banjo Ukulele Kit Banjo Holder Organizer for Kids Teens Adults Beginners Resonator Banjos 4 String Banjo Bag$26,99 Buy product

Responses