MSG Entertainment Reports 17% Q2 2025 Revenue Slip Amid Broader Event Sector Slowdown Concerns

Radio City Music Hall as seen from 51st Street. Photo Credit: PumpkinSky

Madison Square Garden Entertainment (NYSE: MSGE) has reported a 17% year-over-year revenue slip for calendar Q2 2025, which also brought “lower per-concert revenues.”

MSG Entertainment shed light on its fiscal fourth quarter (covering April, May, and June) financials today, pointing to $154.1 million in revenue for the period. That sum reflects the previously mentioned 17% falloff as well as an accelerated decline from the full 12-month window’s 2% YoY decrease to $942.7 million.

Additionally, the quarter’s operating loss came in at $25.8 million, up from $8.9 million in Q2 2024. Revenue tied specifically to events fell $21.6 million YoY, “primarily due to lower revenues from concerts,” the business disclosed.

Keeping the focus on concerts, the Madison Square Garden owner and Radio City Music Hall operator acknowledged a year-over-year dip in the number of Garden music events – albeit with a YoY jump in shows at its theaters. Those trends extend to the quarter and the fiscal year alike.

Digging just a bit deeper here, the MSG show-quantity difference resulted in part from the end of Billy Joel’s residency, the company indicated – while the theater-side boost stemmed from a record number of Radio City concerts on the year.

“[D]uring this past quarter,” CFO David Collins noted, “food and beverage per caps at concerts at the Garden were up, while per caps at our theaters were modestly down as compared to the prior-year quarter.”

In a nutshell, the report appears to be a mixed bag for MSG Entertainment, which is “80% to our [fiscal 2026] bookings goal for the year at the Garden” and “about two-thirds of the way to our goal for our theaters.” (Also on the horizon is a calendar 2026 Garden residency that’s now in “the late planning stages.”)

And that same mixed-bag descriptor might be apt for the wider live music space as well. On one hand, many are aware of certain acts’ touring challenges and the festival sector’s woes. Moreover, Vivid Seats turned in a brutal Q2, and professionals are still sounding the alarm about small-gig venues’ operational obstacles.

On the other hand, Live Nation enjoyed a record second quarter – which may not help the business from the perspective of its antitrust legal difficulties – and it was only in June that Fever scored a $100 million raise before scooping up Dice to boot.

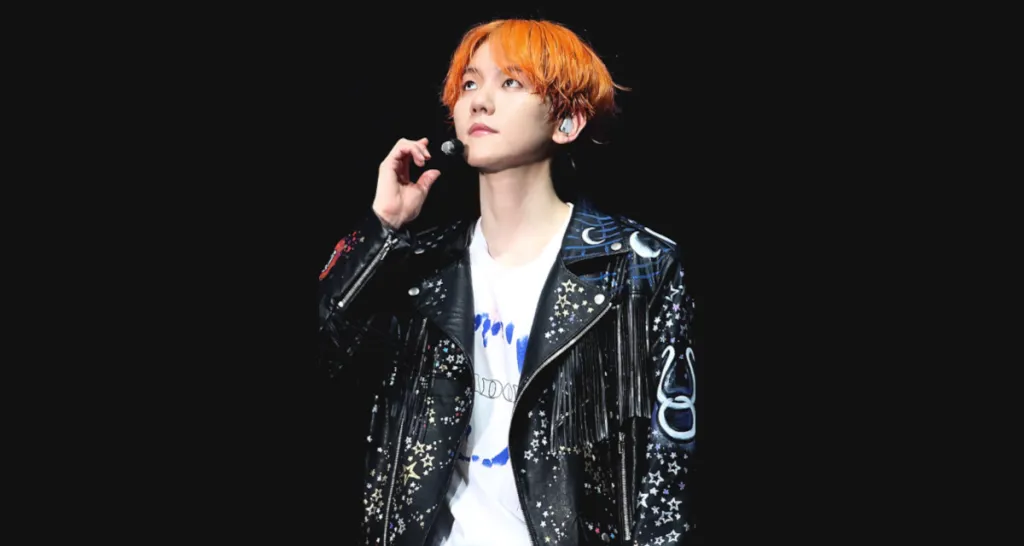

Furthermore, even ahead of BTS’ much-anticipated return and with NewJeans on the shelf, Hybe offset a Q2 recorded music slowdown with (among other things) live performance growth. Plus, the long-awaited StubHub IPO is reportedly in the cards for September.

A final testament to the mixed concerts bag: Sphere Entertainment, which technically owns a chunk of MSG Entertainment, exceeded earnings per share expectations for calendar Q2.

The company’s namesake Vegas venue itself generated $175.6 million (up 16% YoY) during April, May, and June. And despite Sphere’s growing list of residencies, cheaper “evergreen” content may ultimately bump out concerts from the schedule, CEO James Dolan said in different words.

“[I]t could very well be that The Wizard of Oz is doing so well that it nudges out one or two concerts, or corporate [events],” he summed up. “Because I wouldn’t rent the venue to somebody for $1.5 million or $2 million if I can do $4 million with the product that I already have and is already paid for.”

Link to the source article – https://www.digitalmusicnews.com/2025/08/13/madison-square-garden-entertainment-q2-2025-earnings/

-

Remo BJ1100M3 Clear Diplomat Banjo Head (11-Inch) – Medium Collar$39,99 Buy product

-

Descant Soprano Recorder Music Recorder Instrument For Kids Flute Kids Recorder With Cleaning Rod + Case Bag…$8,99 Buy product

-

2pcs Guitar Interface I-Rig Converter Replacement Guitar Audio Interface Guitar for Phone Phone Tuner Lightweight Audio Adapter for iPhone, iPad and Android Smartphones and Tablets Practical Processed$11,99 Buy product

-

CB SKY Full-Size 39“ Adult/Teenagers 13-18 Electric Guitar Vintage Sunbrust Color with 5W Amplifier, Extra Strings, Cable and Guitar Pick$99,99 Buy product

-

Alesis Recital Grand – Digital Piano 88 Weighted Keys with Hammer Action, Sustain Pedal, 16 Premium Voices, Speakers, Piano Lessons, Sheet Music Stand$449,00 Buy product

-

Henry Ossawa Tanner Banjo Lesson Poster 1893 Oil On Painting Man Teaching Boy To Play Banjo Musical Instrument Music Class Cool Wall Decor Art Print Poster 24×36$14,98 Buy product

Responses