Report Finds Majority of Time with Streaming Music Is Now Spent with Paid Platforms

Photo Credit: Andrik Langfield

Edison Research has found a significant shift away from free streaming audio platforms toward paid subscription services.

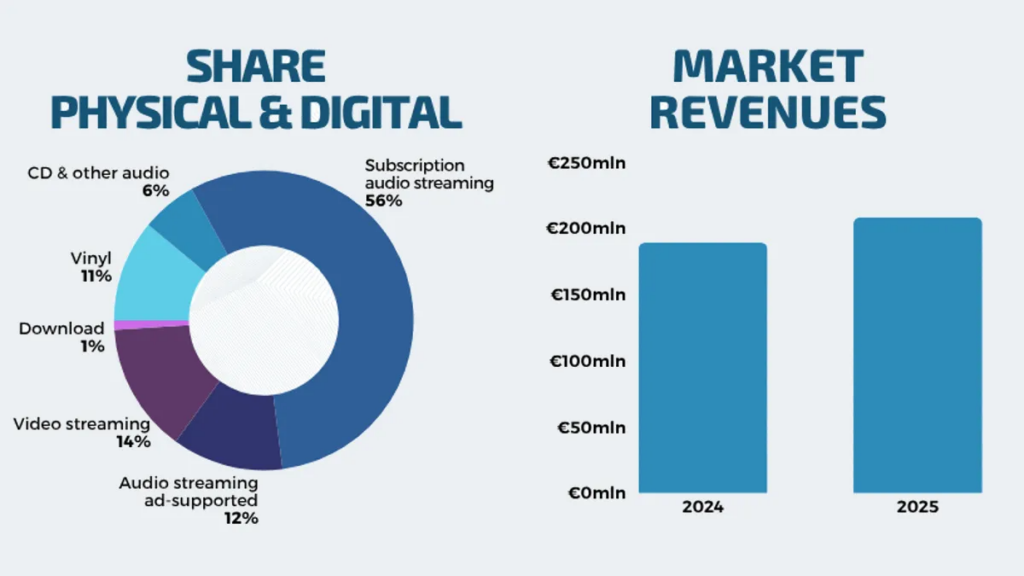

Audio habits and preferences have obviously changed in the last decade, and new data from Edison Research’s Share of Ear study reveals just how much. There’s been a significant shift away from free streaming audio services—with paid plans now dominating the landscape.

As of 2025, the trend is more prevalent than ever, as Americans 13+ spend 66% of their daily streaming music listening with paid platforms and 34% of time with free services.

Back in 2015, over three-quarters of time spent by Americans aged 13 and over with streaming music sources was with free platforms, at 78%. That trend continued into 2016, but started losing ground to paid sources starting in 2017. In 2020, time spent with paid sources surpassed time spent with free alternatives for the first time.

Some years show slight fluctuations in the data, but the overall theme remains consistent: the percentage of time spent with streaming music sources has shifted from free to paid platforms.

Photo Credit: Edison Research

Perhaps the most intriguing aspect of this find is that providers like Amazon, Spotify, YouTube, iHeart, and Pandora all currently offer both free and paid versions of their streaming music platforms. So why the shift in recent years?

There are many potential reasons paid solutions have become the norm, according to Edison Research. These include Americans being less tolerant of advertisements in their audio listening (coupled with the frequency of ads), competitive pricing structures among streaming providers, and subscription services becoming more common as a “package deal” with other media offerings.

While the major players like Spotify and YouTube continue to offer paid and ad-supported tiers, the overall value of ad-free listening has won out for most Americans. That’s interesting, since providers have overall increased prices in recent years and continue to do so in many regions. Compared to DSPs like Spotify, YouTube Music’s growth is actually flat.

But if users can get their ad-free listening tiers bundled into other services they already use (like YouTube Premium offering ad-free YouTube Music listening with a single subscription), it’s hard to turn that down.

Link to the source article – https://www.digitalmusicnews.com/2025/10/29/report-music-streaming-time-paid-platforms-2025/

-

Ibanez M510EBS A-Style Mandolin, Brown Sunburst High Gloss$199,99 Buy product

-

XSONIC Airstep Spk Edition Spark 40&Mini&Go Foot Controller with 5 Footswitches, 4 Control Modes(Change Presets, Toggle Effects, Looper), 300H Playtime, Wirelessly Control Spark for Home and Gig$76,49 Buy product

-

Cornet$0,00 Buy product

-

Novation Launch Control XL MKII USB MIDI controller for Ableton Live with assignable controls$159,99 Buy product

-

Glory GLY-PBK Professional Ebonite Bb Clarinet with 10 Reeds, Stand, Hard Case, Cleaning Cloth, Cork Grease, Mouthpiece Brush and Pad Brush, Black$99,99 Buy product

Responses