Shamrock Dumps Its Godforsaken Taylor Swift Catalog — But Is the Music IP Hangover Just Getting Started?

When it comes to Shamrock Capital’s acquisition of Taylor Swift’s recorded catalog, let’s be honest: it didn’t even seem like a good idea at the time. But is there more frothy fallout ahead when it comes to music IP?

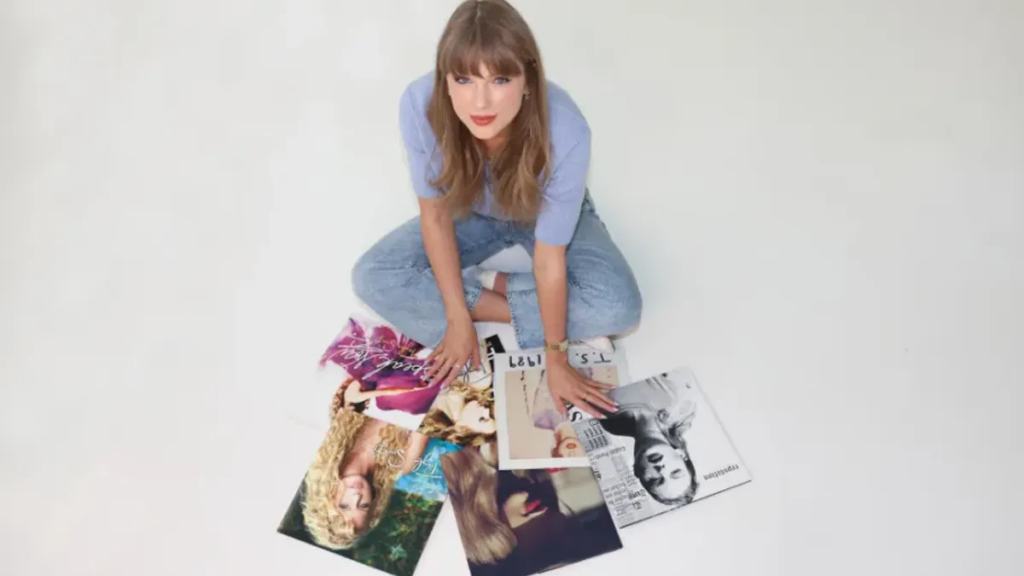

Dialing back to late 2020, the collective head-scratching elevated when Shamrock Capital swooped in to buy Taylor Swift’s first six album masters for $300 million plus. The seller was none other than Scooter Braun’s Ithaca Holdings, who dropped the sullied asset after just 16 months of migraine-inducing ownership.

Of course, it’s always fun to buy the most sizzling catalog on the block. But to say there were red flags around this IP acquisition would be a drastic understatement.

For starters, Swift herself was already stream-rolling forward with her now vast catalog of Taylor’s Version remakes, complete with a fight-the-industry-oppressor narrative to fuel the Swiftie mob. Beyond the juicy targets of Scooter Braun and Scott Borchetta, Big Machine staffers were getting harassed — and woe to any music company or investment house caught in those crosshairs.

Hence Scooter’s EJECT button — or at least part of the explanation for it. Enter Shamrock, which quickly found itself battling duplicate recorded music versions and a hostile artist. That’s tricky enough to manage, but given the edge-case nature of this calamity, building longer-term revenue projections seemed downright devilish. It was all unfortunately unprecedented, particularly for an IP asset of that size.

Then again, investment firms will tolerate almost any level of pain for the right return. This one – involving IP from one of the biggest musicians in history – apparently wasn’t worth it.

The bad math and endless headaches might explain the quick reversion sale – which may have also carried a boulder-off-shoulder post-signing high. Braun got out after 16 months — and now, Shamrock is bowing out after four-and-a-half years. None of that screams long-term portfolio jewel, but hey – now Taylor’s the proud owner of her own original recordings.

That’s great news for Taylor, but is Shamrock’s dump-off the latest episode in a protracted frothy fallout?

Hipgnosis was its own slow-motion train wreck, with execs accusing Massarsky n’ Merc of juicing up the valuations of catalogs into the stratosphere. But what about the rest of the multi-billion dollar music IP ecosystem?

That’s a tricky one, particularly in the daily rollercoaster of America’s economy du jour. Indeed, complementing the stomach-turning stock market is an ‘everything bubble’ terrain replete with endless possible ‘pops’ – including potential crashes in crypto, real estate, bonds, and maybe even music IP.

That has industry players feeling a bit nervous, according to our latest off-the-record convos. There’s still a significant amount of money ready to be deployed on catalogs, and specialized plays involving smaller catalogs and distinct rights tranches continue to emerge.

But is there a bigger correction ahead for music IP?

One problem recently outlined to DMN: even catalogs from storied artists like Bob Dylan (whose total publishing and recording catalog sold for as much as $600 million) only have so many recognizable hits—and sync-able tracks.

Indeed, b-sides blow up and get placed all the time (see Connie Francis’ ‘Pretty Little Baby’ and the Pointer Sisters ‘Hot Together’ for the latest exhibits). But how many people care about the hundreds of lesser-known tracks from legendary artists like Dylan?

In that context, perhaps the Taylor sale speaks volumes – particularly after such a short carriage period by Shamrock.

Not to harsh anyone’s mellow, though perhaps a measured cool-down is the best outcome in this terrain. Indeed, a soft landing might be the luckiest outcome we can get.

Meanwhile, music IP and other hot-button music and money concepts are on tap for next week’s Music Investor Conference, or MIC, in New York, where dealmakers will rub elbows and prognosticate on what’s next. That will be complemented by A2IM’s Indie Week confab in Times Square – with IP sure to receive healthy discussion time at both.

See ya there.

Link to the source article – https://www.digitalmusicnews.com/2025/06/03/shamrock-dumps-taylor-swift-catalog-frothy-hangover/

-

Roland SP-404MKII Drum MachineBuy product

-

Moonlight Bazaar Summer Music Festival Cornet Bb Flat White & Blue finish Cornet With Free Hard Case Mouthpiece For Beginner Student Professional$139,99 Buy product

-

TUBA REAL – Large Unique Original WAVE/Kontakt Multi-Layer Studio Samples Library$14,99 Buy product

-

JBL Professional LSR310S -Channel Studio Subwoofer, 10-Inch, Black$0,00 Buy product

-

Recording King RK-R20 Songster Banjo$599,99 Buy product

-

KRK Classic 5 Near-Field 2-Way Studio Monitor, Black (Pair)$269,00 Buy product

Responses