SiriusXM Posts a Lackluster Quarter, Though Subscribers Are Stabilizing and Podcasting Is a Bright Spot

Photo Credit: SiriusXM

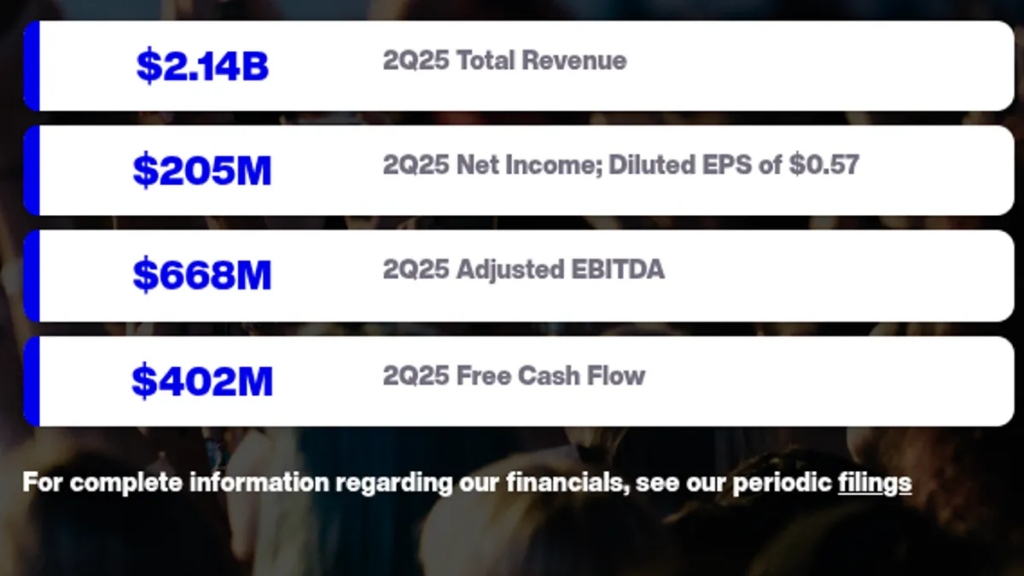

SiriusXM restates its financial projections for 2025, maintaining a positive outlook despite a lackluster quarter. Podcasting remains a bright spot.

SiriusXM anticipates achieving a total revenue of around $8.5 billion, including an adjusted EBITDA of roughly $2.6 billion and a free cash flow approximating $1.15 billion. The company operates almost exclusively in the U.S. through its SiriusXM and Pandora audio services.

Further, the company has agreements with automakers to install its radios in vehicles, providing trial services to vehicle buyers, which traditionally feeds its subscriber base. Pandora is a smaller revenue contributor, providing a subscription and ad-supported streaming music service competing with industry giants like Spotify, Apple Music, and YouTube Music. SiriusXM also offers a streaming option.

With a market capitalization of approximately $7.75 billion, SiriusXM is positioned within the Communication Services sector, specifically in the Media-Diversified industry. This positioning highlights its role as a significant player in the audio entertainment market.

SiriusXM’s financial health offers a mixed bag. The company reported a trailing twelve-month revenue of $8.605 billion, reflecting a modest one-year growth of 0.6%. Over longer periods, revenue growth has been more robust, with three- and five-year growth rates of 7% and 9.5%, respectively. However, the total revenue growth over the past year has declined by 4.1%.

The company’s balance sheet shows a current ratio of 0.42, indicating potential liquidity constraints. The debt-to-equity ratio sits at 0.93, suggesting a moderate level of leverage. The Altman Z-Score of 0.94 actually places SiriusXM in the distress zone, indicating potential financial distress within the next two years.

SiriusXM’s revenue trends highlight its reliance on its core satellite radio service, with growth driven by strategic partnerships with automakers and the expansion of its streaming services. Despite these efforts, the company’s operational efficiency metrics suggest room for improvement in profitability and cost management.

Moreover, SiriusXM faces challenges from streaming giants like Spotify and Apple Music—but the company’s unique content offerings and established automotive partnerships provide a competitive edge.

SiriusXM’s current trading metrics paint a complex picture. The company has a price-to-sales ratio of 0.95 and a price-to-book ratio of 0.69, both of which are relatively low compared to its track record. Technical indicators, such as the Relative Strength Index of 45.16, suggest that the stock is neither overbought nor oversold. Institutional ownership indicates strong interest from large investors, sitting high at 73.16%, while insider ownership is 7.4%.

Other risks include the rapidly evolving media landscape and continued competition from streaming services. But SiriusXM’s established brand and strategic partnerships provide some protection from these risks. Overall, the company’s projections for 2025 reflect a positive outlook, but its current financial health and market positioning present both opportunities and challenges for investors.

Link to the source article – https://www.digitalmusicnews.com/2025/07/31/siriusxm-lackluster-q2-2025/

Recommended for you

-

Fender Champion 40 Guitar Amplifier, with 2-Year Warranty$229,99 Buy From Amazon

-

Fender Player Stratocaster HSS Electric Guitar, with 2-Year Warranty, Buttercream, Maple FingerboardBuy From Amazon

-

Rode AI-Micro USB Audio Interface,Black$79,00 Buy From Amazon

-

Ernie Ball Regular Slinky Nickel Wound Electric Guitar Strings 3 Pack – 10-46 Gauge$17,99 Buy From Amazon

-

Yamaha HS8S Powered Studio Subwoofer 8″ + (3) XLR to XLR Cables$0,00 Buy From Amazon

-

Alesis Drum Essentials Bundle – Complete Electric Drum Set Accessory Pack including A Drum Throne and On-Ear Headphones$99,00 Buy From Amazon

-

Banjo Miniature Replica, Miniature Banjo Model with Delicate Box, el Decor, Miniature Wooden Guitar Model Display$21,02 Buy From Amazon

-

Rhythm C Flutes with Engraved Flower Closed Hole 16 Keys Flute For Student, Beginner with Stand, Carrying Case,Cleaning Kit, Gloves, Tuning Rod, Nickel$69,99 Buy From Amazon

Responses