Wall Street’s Not Feelin’ Spotify—SPOT Remains Down 10%+ Following Disappointing Q2 Earnings

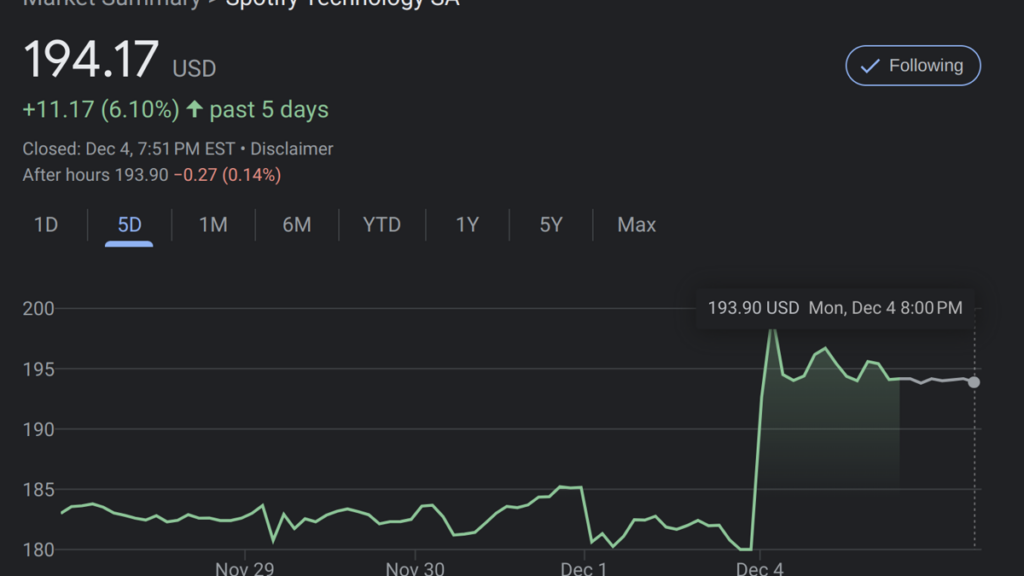

Photo Credit: Google (SPOT stock)

Spotify’s latest Q2 2025 earnings report delivered robust subscriber and monthly active user growth, but those positive markers didn’t shield the company from investor disappointment.

Following the report, Spotify’s stock fell sharply, wiping out nearly $15 billion in market value. From a pre-earnings high of $702, shares have slid to roughly $627, with no rebound in sight. Premium subscribers climbed 12% year-over-year to reach 276 million, with total monthly active users (MAUs) growing 11% to 696 million. This was the second-best quarter for net MAU additions in Spotify’s history, with subscriber net adds up more than 30% compared to the prior year.

Revenue also increased by 10% to €4.2 billion ($4.85 billion). However, these strong user numbers could not compensate for mounting cost pressures and a revenue miss—the report showed a significant hit from currency fluctuations and a shift to a quarterly net loss. Spotify posted a deficit of 42 euro cents per share, translating to a €86 million ($100 million) loss in Q2 and reversing last year’s €274 million profit.

The combination of a lower-than-expected ad revenue, higher payroll costs, and compensation tied to share price performance weighed heavily on SPOT margins. Ad revenue, in particular, disappointed, growing just 5% on a currency-neutral basis—which CEO Daniel Ek directly addressed. He admitted during an investor call that he was disappointed in the ad growth and said that the long-anticipated rebound in ad-supported revenue is not yet materializing.

“We recognize we need to accelerate in this area,” Ek said of growing ad-supported revenue. “The key takeaway is that in 2025, we are reassessing our advertising strategy. We are behind our planned schedule and we hold high expectations for all of our sectors, particularly in advertising where we need to see more advancements that have not materialized yet.”

“Not every choice will provide instant benefits, and our advancement is not always straightforward,” Ek told investors. “We don’t make choices to achieve specific, short-term quarterly results.”

When asked about pricing power, Ek told investors, “It’s far more advantageous to maintain a customer for an extended period than to lose them and later attempt to win them back. In the subscription business, especially at scale, the emphasis is on retention rather than merely acquiring new customers. We look at each market and we make the determination, is now the right time for a price increase or not? And in most of developed markets, at this point, it isn’t.”

Link to the source article – https://www.digitalmusicnews.com/2025/08/01/wall-street-spotify-stock-down/

-

Rock Keyboard Modern – Large Unique WAVe/Kontakt samples/loops studio LibraryBuy From Amazon

-

Donner DKA-20 Keyboard Amplifier 20 Watt Keyboard AMP with Aux in and Two Channels, Bass Guitar Amp, Piano Amplifier, Electronic Drum Speaker Support for Microphone Input$139,99 Buy From Amazon

-

Mendini by Cecilio Tenor Saxophone, L+92D B Flat, Case, Tuner, Mouthpiece, Gold$0,00 Buy From Amazon

-

Tristar 4 Valve Echo Cornet Attchd Mute$175,99 Buy From Amazon

-

Oriental Spirit MEGA Bundle – 11 Large Essentials WAVE Samples/Loop Studio Libraries$39,99 Buy From Amazon

-

Roy Benson MOD.CR-302S BB Cornett Silver Plated Finish with Light Rectangular Case$57,04 Buy From Amazon

Responses